Filing and Reporting Requirements for Charitable Organizations

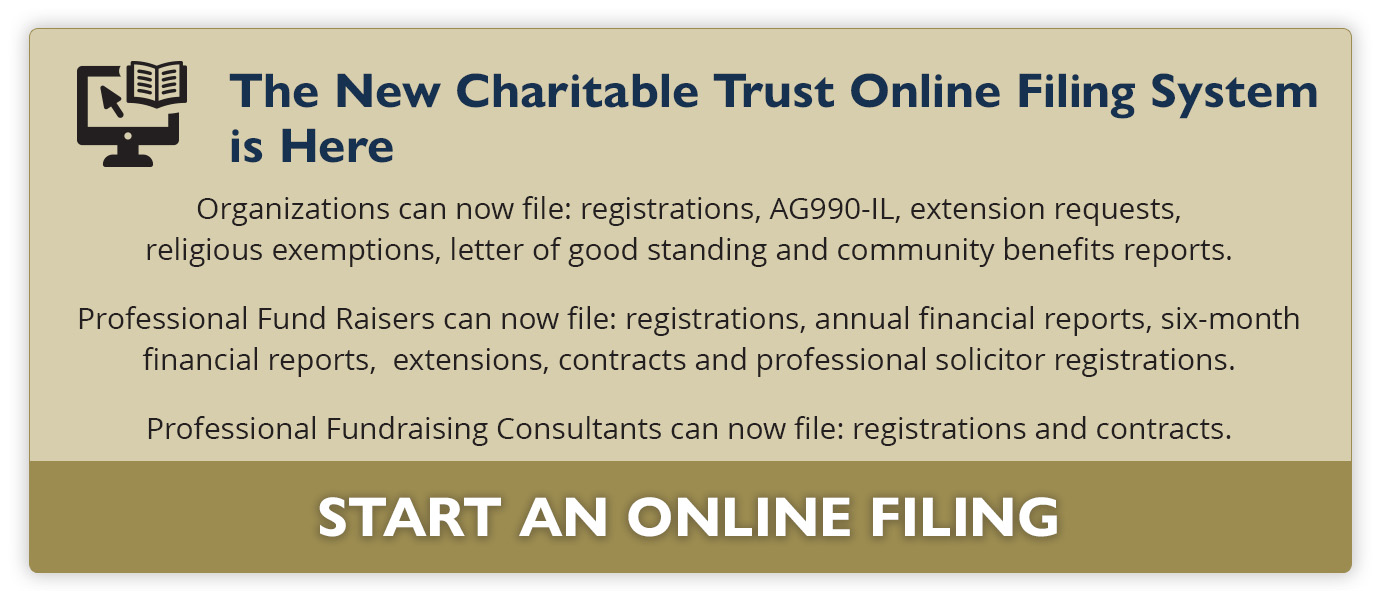

The Attorney General's Office is transitioning to online filing. However, the following forms can be used when registering a charity or professional fund-raising organization with the Illinois Attorney General's Office or when filing annual reports as required by Illinois law. If you have problems downloading any of these forms, please call the Charitable Trust Bureau at (312) 814-2595 for further assistance.

NEW: As of January 1, 2024, there are new dollar amounts for the contribution thresholds that require an Audit or a Review of Financial Statement with the annual report.

Charitable Organization Registration Forms

$15.00 Registration Fee, Check made payable to the Illinois Charity Bureau Fund

- Instruction SheetInstructions for registration as a charitable organization. Includes explanations of the forms needed, attachments required, and fees required for registration as a charitable organization.

- CO-1 Registration StatementRegistration Statement for Charitable Organizations.

- CO-2 Financial Information FormFinancial Information Form to be filed along with the CO-1 form when registering a charitable organization

- CO-3 Religious Exemption FormApplication for exemption from filing annual reports for religious organizations. Should be filed along with the registration forms.

Charitable Organization Annual Financial Report Forms

- AG990-IL Charitable Organization Annual ReportThis is the annual report form to be filed by charitable organizations registered with the Illinois Attorney General's office.

- IFC Report of Individual Fund-Raising CampaignThis is an attachment to the AG990-IL form for charitable organizations that use the services of a professional fund raiser.

- Form AG990-IL Filing InstructionsThese are the instructions for completing and filing the AG990-IL form and all required attachments and fees.

- Charity Annual Report ExtensionsThese are the instructions for requesting and receiving an extension of time for filing the annual report.

Annual Non-Profit Hospital Community Benefits Plan Form and Instructions

- Form CBP-1 Community Benefits Plan Annual Report Form for Non-Profit Hospitals (to be used for reporting periods ending after 1/1/2022)

- Form CBP-1 Instructions Instructions for reporting Community Benefits (to be used for reporting periods between 1/1/22 and 12/31/2023)

- Updated Form CBP-1 Instructions Updated Instructions for reporting Community Benefits (to be used for reporting periods ending after 1/1/2024)

- Hospital Financial Assistance Form

Copies of Annual Non-Profit Hospital Community Benefits Plan Form submissions are available upon request. To obtain printed copies of Annual Non-Profit Hospital Community Benefits Plan report submissions, send a written request to:

Office of the Illinois Attorney General

Charitable Trust Bureau

115 S. LaSalle St.

Chicago, IL 60603

Note: Non-Profit Hospitals prepare their own reports, and the Attorney General’s office cannot guarantee the accuracy, quality or validity of the information.